Stocks Fallen: Nvidia hit by DeepSeek

Ladies and gentlemen, gather around for the latest episode of "Tech Wars: The Rise of the AI Titans." Today’s protagonist—or antagonist, depending on which side of the stock market you’re on—is none other than China’s DeepSeek AI. This scrappy startup has managed to shake the foundations of Silicon Valley and send Nvidia, the reigning king of AI hardware, into a tailspin. If you thought AI was just about chatbots and self-driving cars, think again. DeepSeek has made it clear that the battle for AI supremacy is also a battle for cost efficiency, technological dominance, and, apparently, Wall Street’s collective sanity.

A Cinderella Story (With Chips Instead of Glass Slippers)

DeepSeek’s models are reportedly 20-40 times cheaper than equivalent models from OpenAI. Yes, you read that right. While OpenAI is out here charging premium prices, DeepSeek is essentially running a "Black Friday Sale" on AI models year-round.

Unlike most AI giants that rely on Nvidia’s high-performance chips, DeepSeek has managed to achieve impressive results using less powerful hardware. This is like winning a Formula 1 race in a Prius—unheard of but undeniably impressive.

DeepSeek’s models are open-source, which means they’re available for free. This has not only democratized access to advanced AI but also raised questions about whether the tech industry has been overspending on proprietary solutions.

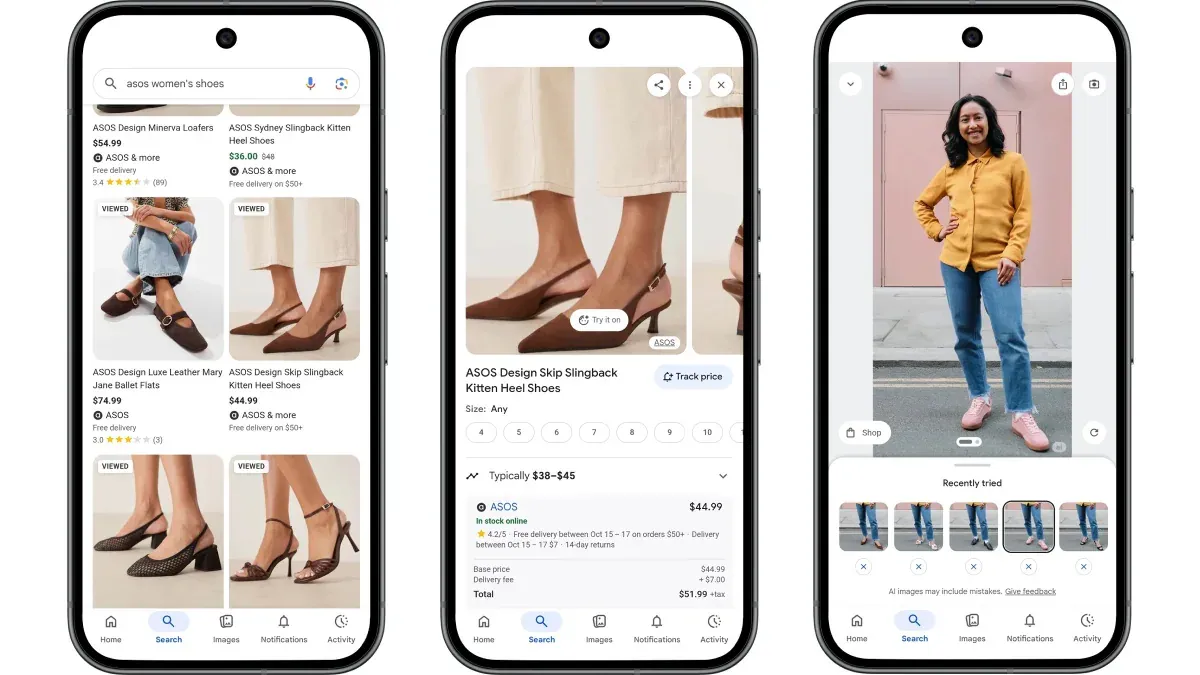

DeepSeek’s R1 model has skyrocketed to the top of Apple’s App Store charts, dethroning OpenAI’s ChatGPT as the most downloaded free app. This is like a new band knocking The Beatles off the charts—an event that’s sure to ruffle some feathers.

Nvidia’s Nightmare: The Fallout

Now, let’s talk about Nvidia, the chip-making giant that has been the backbone of AI development for years. Nvidia’s GPUs are the gold standard for training and running large language models (LLMs). However, DeepSeek’s success has thrown a wrench into Nvidia’s well-oiled machine. Here’s how:

Nvidia’s stock plunged by as much as 14% in pre-market trading on January 27, 2025. Other tech stocks, including ASML and Broadcom, also took a hit, with the Nasdaq index dropping by nearly 4%. It’s safe to say that Wall Street is not having a good day.

Analysts are now questioning whether Nvidia’s premium chips are still worth the price. If companies like DeepSeek can achieve similar results with less powerful hardware, why pay a premium? This has led to a broader reckoning about the economics of AI.

DeepSeek’s ability to train models using less powerful chips could inspire other companies to follow suit. This would reduce demand for Nvidia’s high-end GPUs, potentially impacting the company’s revenue and market dominance .

Implications for the Tech Industry

DeepSeek’s rise is not just a story about one company disrupting another; it’s a wake-up call for the entire tech industry. Here are some of the broader implications:

- Shift in AI Economics: DeepSeek has proven that you don’t need to spend billions to develop cutting-edge AI. This could lead to a shift in how companies allocate resources and prioritize efficiency over brute force.

- Geopolitical Ramifications: The U.S. government has been trying to maintain its lead in AI by restricting the export of advanced chips to China. However, DeepSeek’s success shows that China can innovate even with limited access to high-end hardware. This could have significant implications for global tech competition.

- Open Source vs. Proprietary Models: DeepSeek’s open-source approach challenges the proprietary models of companies like OpenAI and Google. This could democratize access to AI but also raise questions about intellectual property and data security.

What’s Next for Nvidia?

So, what does the future hold for Nvidia? While the company is undoubtedly facing challenges, it’s not time to write its obituary just yet. Nvidia still has a significant advantage in high-end GPUs, which are essential for many advanced applications. However, the company will need to adapt to the changing landscape by focusing on cost efficiency and exploring new markets.

In the grand scheme of things, DeepSeek’s rise is a testament to the power of innovation and the importance of challenging the status quo. While Nvidia may be feeling the heat, this disruption could ultimately lead to a more competitive and efficient AI industry. As for DeepSeek, it has proven that sometimes, the underdog can not only compete but also redefine the game.

So, here’s to DeepSeek for shaking things up and to Nvidia for hopefully rising to the challenge. And to the rest of us, let’s grab some popcorn and enjoy the show—because the AI wars are just getting started.